If you are a foreign company interested in expanding your business to Mexico, then you must be aware of the costs and taxation of doing business in Mexico as a foreign entity.

Comparing China with the costs and taxation of doing business in Mexico

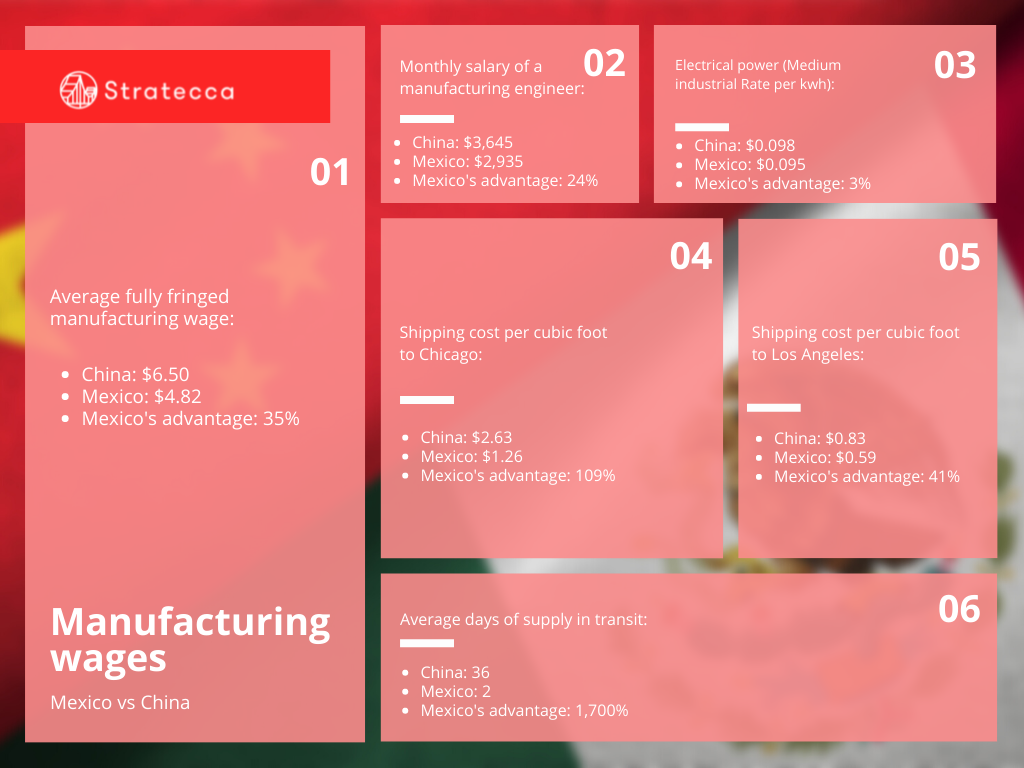

I want to begin comparing the costs, of doing business in Mexico, with some of the same costs of doing business in China. Let’s start with fully fringed manufacturing wages.

The image above represents something fully fringed. It includes all the government taxes, so on and this information is drawn from a recent study that was conducted to compare Mexico and China, by a third party. Although it is not our internal study, it relates pretty well with our experiences.

So when we talk about skilled manufacturing workers, and this is for all of Mexico, obviously; different locations are going to vary, and also the different job descriptions. But, we can see a similar position in China, costing $6.50, as compared to Mexico at $4.82. Well, at that skilled level we have a 35% advantage for Mexico.

Similarly, if we talk about a monthly salary for a manufacturing engineer, someone with at least three to five years of experience; We’re going to have $3645.00 in China versus the same person costing us $2935 a month in Mexico. So, that’s a 24% advantage to Mexico. There is a big difference in those wages, since China increased their cost significantly from what they were ten years ago. And that’s an advantage for doing business in Mexico.

Now, I should add, that as we move up the professional level, and experience and professional qualifications increase, the gap to compensation packages in Canada lessens. So, if you’re talking about general managers or plant managers; senior people in the organization, they are going to be paid more similarly to what you would pay in Canada. The gap is much lower at the lower end of the of the salary scale.

The costs and taxation of doing business in Mexico: electricity, shipping costs and real estate

Electrical power in Mexico is controlled by a central utility, called CFE. It’s slightly cheaper than China, but, the advantage is relatively small. However, the key point is that it’s competitive globally. This is a rate that includes, demand charges and power factors, and so on. And you can see this is competitive Globally.

When discussing costs and taxation of doing business in Mexico; Shipping costs are a significant factor.

Bear in mind that this comparison is about a year old, so this gap is now significantly larger! But, about a year ago, if you compared the shipping costs from China to Chicago, including the container plus the land based surface transport, it was about $2.63 US per cubic foot. But, the same load coming from Mexico, could be landed in a $1.26 US, so that’s a significant advantage again for Mexico over China.

If you took the same load and simply landed it in Los Angeles, obviously the gap is less, because the ocean transport from China is relatively inexpensive, but that’s $0.83 versus $0.59; so still, a significant cost advantage from Mexico. And as was mentioned previously, a key point is those days of supply. So, surface transport from China is approximately 35 to 40 days, not at all unusual, during which time you are typically vulnerable to environmental disruption and other supply chain problems.

On the other hand, transport from Mexico comes down to only two days by truck, which is accessible to almost every industrial region in Mexico. And, you could put a straight through truck to Montreal quicker than that if you want to.

Of course it isn’t just labour and freight times that you need.

You need real estate.

When talking real estate, the costs and taxation of doing business in Mexico is quite competitive, as you can see from this the graph below; and of course, there’s a variation throughout location as there always is.

You’re of course going to find variation with any new market, in terms of the conditions of the building and the location of that building. What I’m showing here is the triple net lease rates in U.S. dollars per square foot per month. This is because that’s typically how a lot of landlords want their leases structured in Mexico.

You certainly find landlords that want to be paid in pesos, but it’s not uncommon to have leases in U.S dollars; and it is typical to put rents in per month, rather than per year or some other figure. So as you can see from this graph, that’s somewhere between as low of $0.25. per square foot and a high of $0.48 or $0.50 per square foot, triple net rates.

You can find Class A buildings in Mexico that are going to meet any international standard for manufacturing operations. If you are able, with your operation, to use a Class B or Class C building, or perhaps a building with your features then you can get it even for less cost.

In the image above, on the right-hand side, you’ll find some onetime costs that you are going to face, and I want to focus on a couple of these, because they do have an impact, particularly if you are thinking of purchasing land. And by the way, purchasing property in Mexico, it does vary widely, between cities in some locations.

Guadalajara is a good example.

The real estate market is relatively closely held when you’re talking about commercial real estate. There’s not a lot of availability of properties for purchase. Many of the landlords prefer to have the income, rather than realize their assets, so consequently property can be quite expensive.

And as a foreign investor, you can purchase property, you can also of course have a Mexican corporation, or purchase property that way, but of those onetime costs, one that you’ve got to be aware of is electrical demand.

If you have more than 200 KVA, the CFE requires you to make a onetime purchase at a rate of approximately $100 U.S. dollars per kva of the demand that you’re going to require. If you have a high demand that can be significant.

Most landlords are going to have properties that do not have much installed capacity. You’re going to be responsible for the transformers, and for those extra kva’s; another thing you need is an environmental study. It’s not very expensive, but the mitigation efforts that you need to put in may cost money. But you need to be aware it requires time to get it. Technically, third-party environmental studies are going to run 1500 to $5000.

You are also typically required to put up bonds for utility suppliers. Some utility providers of telecommunications, for example, will agree to waive the bonds. Others, like CFE, probably won’t. And you need electrical certification. Again, this takes time and you need a Mexican engineer to certify your electrical insulation.

On its own, Fire system is not a signifcant one, but the utility connection fee is very important.

When you’re looking at property, make sure you know what utilities are available, what the capacity is, and who’s going to be responsible for installing any difference in capacity that’s required. This can be really important when you’re buying property.

On service property, there may be significant costs associated with running utilities, and you may be responsible for those costs. In other cases, the landlord is going to have it fully installed.

You’re going to want to talk to your own accounting people and people who are experts in taxation, but here’s a quick overview.

The costs and taxation of doing business in Mexico: different tax rates apply to different companies

The first one, is the value added tax, known as IVA. And the value added tax in Mexico works very much like the HST or the GST in Canada.

It applies to most goods and services in Mexico.

There are two rates:

An 8% rate applies to some specific border zones. There’s also a set of criteria that you need to meet to qualify for that 8% rate. It’s relatively limited in scope. So, for some companies that will be possible.

For many others it will not. If you’re neither located in those zones, or if you just can’t qualify, then you’ll be looking at the 16% rate on most goods and services. And as I’m going to explain in a minute, that rate can be mitigated, and avoided.

The same thing for corporate tax, there’s a 20% rate that applies in those northern and southern border zones, subject to exactly the same criteria as the IVA rates. Most companies will be looking at the 30% rate of corporate taxation, and I should mention a couple things about corporate taxation.

First of all, Mexico does have a tax treaty with Canada. So any corporate tax you pay in Mexico, can be deducted from your Canadian corporate tax, income offset against it.

Also, Mexico offers a safe Harbor provision, so if you’re in an arm’s length transaction basis, which many companies will be, then you can choose to use the Safe Harbor Provision, which is essentially that 6.5% of your assets in Mexico, or 6.9% of your expenditures in Mexico, whichever is , can be used as a proxy for your income, and then the tax rate is applied to that figure.

So if that works out favourably, and it does for many companies then that’s a simple way to calculate your corporate tax in Mexico. It’s recognized by Canadian tax authorities, and you can offset it against your Canadian income tax.

If you happen to be in an arm’s length situation and not eligible, or the Safe Harbor provision is not attractive to you, then you must negotiate a transfer pricing agreement. That takes more legal and accounting work. So it costs a lot more money. But for some companies that’s the better option.

There’s also a real estate tax in Mexico that’s typically the main source of municipal income. It ranges from 0.1% to 0.5% of assessed value. If you’re leasing, the landlord’s going to probably incorporate that into a TMI payment as part of the lease, or require you to show that you’re paying it.

In other cases, if you own the property then you’ll pay that. Usually it is not a big number, but you do need to be aware of it.

And there’s a state payroll tax, which is a key source of income for the states since it applies to your payroll in Mexico. It ranges from 1.8% to 2.9% depending on the states, and so that tax is also one that you need to be aware of now. And, an important point is that IMMEX or IMMEX Shelter providers can avoid the value added tax.

So, IMMEX is a program for exporters.

There are a number of IMMEX options, some of which apply to Mexican companies. Others are available for foreign companies, and the ones of main interest to foreign companies are the “Maquiladora-Pura”, which applies to corporations, and the Shelter provider or “albergue”; Which applies to shelter operations.

In both cases you must have foreign ownership and there are requirements to be met in terms of asset ownership to show that you meet the foreign ownership requirement.

Secondly, you must export all goods. Now, that can be physically or virtually. Physical is obvious. They go outside of Mexico -they’re exported.

Meanwhile, in a virtual export, which is a very common part of the economy in Mexico, allows you to ship goods between IMMEX companies in Mexico, whether you’re buying or selling, and to consider those goods, as exports and imports according to federal law.

So virtual exporting is very attractive, because you can continue to move goods in and across Mexico, so they can meet the IMMEX requirement and you don’t need to collect, or remit value added tax if you’re both IMMEX companies.

A lot of business is done that way in Mexico. But, there is paperwork associated with it; You do need import-export people managing that operation for you, and there’s some requirements in terms of documentation, but that’s an available option.

One of the key things is, you do need a foreign invoice if you’re going to show that these transactions are foreign; and so, your invoicing and ordering comes from a foreign entity.

Whereas your physical shipment can perhaps transact within Mexico, or it can go outside. I just want to clarify, if you need both – if you have a lot of export activity – within or outside Mexico, but you also need a Mexican invoice.

There are ways of setting up your organization, such that you can definitively import some goods and sell them in Mexico, with an invoice with value added tax, while you are producing goods that are in an IMMEX facility. But I won’t go into the complexities of it right now.

For that, I recommend you make an appointment with one of our experts.

Want to discuss how a Shelter service provider can help you reduce costs and taxation of doing business in Mexico?

All these options under IMMEX will allow you to avoid value added tax. I say avoid in the sense, that there are some vendors that cannot avoid charging you value added tax. For example, if you go to Walmart and buy paper for your operation, you’re going to pay value added tax, but you can collect that back.

There’s a cash flow implementation, but you can file for it and it gets remitted to you if you’re an IMMEX company. There is a certification that takes time to get. If you have the certification, you don’t need to pay the value added tax in other situations and wait to get it back later.

You just simply don’t pay it, and particularly that’s important when you’re bringing goods across the border and importing them into Mexico. If you don’t want to pay the value added tax, and wait to get it back, then the certification will take some time.

Lastly, if you start your own company, there’s time required and hurdles required, before you will be certified. But, if using a Shelter provider is your course of action, unless you are dealing with a new Shelter, then the Shelter provider will already be certified. So, if you work with a Shelter, in most likelyhood you’ll already be under a certification program.

So in a nutshell, IMMEX is a key point in reducing costs and taxation of doing business in Mexico, as a foreign company.

Are you interested in doing business in Mexico? Check out our 4 module program that’ll help you export your business to Mexico.

2 comments

Comments are closed.