How to do business in Mexico encompasses a lot of things and I’m trying to summarize it as much as possible and I’m sure there’s going to be a lot of doubts, but please bare with me and I will get through with it.

So, you are a Canadian company interested in manufacturing in Mexico?

OK, the first step on how to do business in Mexico is the level of compromise that you want to acquire in the country. And the level of compromise goes to the structure and the format of the business that you want to perform. And here there are 2 elements, one is considered permanent establishment and the other one is considered not permanent establishment.

The typical non-permanent establishment is a sales office. You open up an office here just for sales and you continue doing your business from Canada to the Mexican customers and that’s about it. There aren’t a lot of responsibilities or risks and legal exposure.

On the other end is a permanent establishment operation which basically is a wholly owned subsidiary. That means foreign entities, Canadian entities, can create a Mexican entity on the laws of Mexico, own 100% of the company there. There is liability and that will create a new company with the tax implications, legal exposure and legal implications in this country.

Let’s talk about taxation in Mexico and how they might affect manufacturing

Fortunately, because of the previous NAFTA and the actual USMCA, those legal implications can be managed because of the double taxation system that we have. That means that if you pay some taxes in Mexico they could be recognized as paid taxes in Canada.

In the case of taxes in Mexico you should consider there are basically 3 levels of taxes.

Federal level, state level and city or municipal level.

In the case of Mexico 93% approximately of all the taxation rainbow is federal taxes. That is, the taxation concentrated in federal taxes. Then there are a few state taxes and even fewer city taxes. The one of the main taxes at federal level is value added tax. Which is 16% of the total value of the invoice. Every business transaction in Mexico must include it and is what we call territorial. Every time you import something, at the moment of importation, you start paying VAT and then when you, sell that product in Mexico you charge VAT so it’s basically a balance of VAT.

Normally a business transaction, when you sell a product, the value that you charge for it is normally higher than the one you pay, and that’s the concept of Value Added tax, which is the value added your company will create. In Canada you are very familiar with it.

There are some exceptions for the border area in which the value added is only 8% instead of 16. But they had some considerations that they had to follow and most of foreign companies will not be able to apply for it. But it’s something that we have to analyze in depth. The other important tax in Mexico, Is the corporate tax, which is a fixed 30% of the profit. Which is pretty much similar to other countries. There is also an exception in the border-towns operations which applies for some companies, but do not apply for special import/export operations or foreign companies.

Finally, is a what we call Safe Harbor tax. This is a special tax that applies for operation of foreign companies that are considered basically cost-centres. That means they do not have actual revenues in the sense of a normal corporation, and for that it will apply a 6.5% or 6.9%, depending on cost and expenses or total assets; in order to determine the profit of the company and then to apply the 30% on that.

There is one additional element to consider. It is not really a tax but is a tax related issue. And that is the Profit Sharing which the Mexican constitution states that companies are required to share their profit with their workers. That is 10% of the actual taxable profit. This has to be considered for a good planification on how you’re going to structure your profits and how you’re going to handle that, at the moment of paying that profit share.

Considerations on Import and export duties in Mexico

There are import duties in Mexico. They range from zero to about 30%, but most of them are around 5%. Well, I should say most of them are zero. Some of them are 5%, and very few of others are more than that.

Then there are special taxes for tobacco, alcohol, gasoline, diesel, but most of the operations do not involve these taxes.

Then at state level there is one tax, basically, is called payroll tax and is based on total payroll of every company and ranks from 1% to 3%, depending on which state you do business. Most of them are 2% but that depends on your location.

And then finally, there are, taxes at City level, which are basically property taxes are related with property. There are some permits, fees, and operation fees, but they are minimal in the case of most operations.

And then just to get more information on imports and exports considerations, as I mentioned before, all merchandise imported into this Mexico has to pay VAT at the moment of entrance into the country. As soon as you clear customs you have to pay duties. Also, you have to pay any contravening duty that may exist for that specific product.

Most of the exports are taxed at duties, but they are zero most of the time. Probably 99% of them are zero except for a specific product like oil, or corn or things like that, which are strategic for the country. But most of them are zero. Also, they are taxed 0 VAT.

If you going to pay import VAT and then you are not going to collect if you export the goods, and then there is an issue on how to handle that VAT, and for that purpose is the government creates some programs to be followed.

To import in Mexico, you need a license from the tax authorities, and you need a licensed custom brocker as in other countries, in which whether you use the custom broker or not in this country, by law you have to use it. There is no other option, it is important you know this system and you know your customs broker in order to operate in Mexico.

Free trade agreements with Mexico

Mexico has 12 free trade agreements with 46 countries, 32 investment protection and promotion agreements and 9 specific sector trade agreements with different countries, especially in South America.

The key of most of these free trade agreements, or specific sector agreements, is the rule of origin. The rule of origin sets the standard in order to apply for exemption duties or not. So it’s important to understand how it works.

The rule of origin varies for the different Free trade agreements. It is not the same one we have with the USMCA and this is not the same with Europe, which is not the same with the other ones that we might have.

It’s important to understand how the rule of origin works in order to create from scratch how you are going to establish the operation in this country, or whether to include an extra process or not.

As I mentioned before, there are possibilities to avoid the payment of VAT. On the entrance of goods, especially if it’s something that you’re going to transform in Mexico for later, exporting it in a new product. So instead of paying on the entrance and then zero at the export, and then requesting the government give you back the VAT, well the government created a program that’s called IMMEX program, which is basically that.

The IMMEX program allows you to import raw material and equipment on temporary basis because they are going to be exported again. To apply for the IMMEX program, the one who apply is a Mexican entity, or Mexican corporations; And most likely they’re going to ask you for; What is the manufacturing process that you want to do? What is the build of materials of your products? How do you intend to dispose of defective products and so forth?

They will visit your facility, Of course, to check that everything is in place and later on they can approver and issue the IMMEX license and registration.

Later you have to apply for the tax exemption with the tax authority, but if you are not indexed (IMMEX approved), you cannot ask for the tax exemption. So, you need that in order to do the following.

There is another program called PROSEC and this program was created basically for the Article 303 of the NAFTA, in which basically the United States says; “Well, Mexico. You have this program IMMEX that will allow companies to import foreign goods with no duties or taxes. And then they’re going to be transformed into Mexico. And because that transformation would meet the rule of origin and therefore that product will be exported to the United States or Canada with no duties! And I do apply duties for those raw materials.” And then the suggestion to Mexico was “Make them pay your duties and if they pay your duties, then I’m OK with it.”

So, Mexico created this program in which they lowered the duties on raw materials and components in order to make it easier for the import/exporters to apply for the program and operate in Mexico. This was first implemented under the previous NAFTA and the now it continues under the 2021 USMCA.

This is a diagram on how IMMEX works. You are company X in country A. You buy raw materials from your own country or other countries. You buy them and pay them and you manufacture it and you sell it to customers in country A,B or C whatever.

How it might change with a company in Mexico? Let’s call it an IMMEX company in Mexico. Well, you send the partner materials on consignment to your company in Mexico. Therefore, go into the program with no duties nor VAT, transforming in Mexico and exported again to the customers abroad. The operation will be done in Mexico, but the actual selling and collecting money will be in your own country or the country you use right now.

In that sense, the IMMEX company Mexico become a cost-centre, practically a production line. You can also have customers in Mexico most likely subsidiaries of your own customers abroad. They can receive new products in Mexico for further transformation and then later on export it again. Once again you do the transaction with that company abroad or with the local corporation or subsidiary Mexico. The goods are delivered in Mexico to this other company. The only requirement is that this other corporation in Mexico must also be indexed (IMMEX company) and we use the process called “virtual import/export operation” in order to do so.

You can also have suppliers doing the same mechanism. The transaction is done with a Company in your country but the goods are delivered to the IMMEX company in Mexico.

With these, basically, when you import physically or virtually a good, you open a tab. Let’s put it that way, with imports, duties and taxes, and you close that tab whenever you export the goods thoroughly.

That’s basically what the government wants.

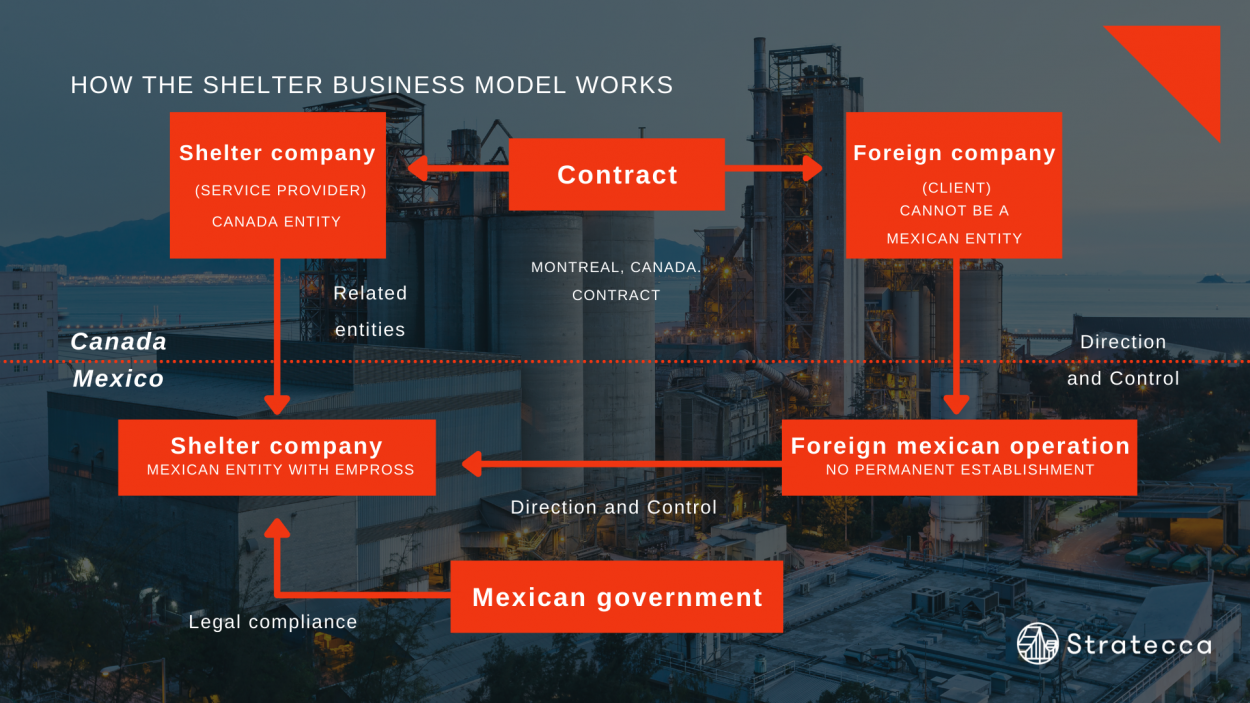

There is a third avenue which is the Shelter model.

What is the shelter? It is basically a Mexican corporation. For example, DIMSA is a Mexican corporation That has all IMMEX program in place. The VAT certification to not pay VAT or get it back sooner. And all the knowledge to do import/export so that we can put our company to your disposal in order to operate your processes in this Mexico.

And I will describe how it works.

So a shelter is a non-permanent establishment type of operation. But you control the whole operation. Why? Because the shelter doesn’t know how to do whatever product you are going to manufacture, that remains under your control. A shelter company provides the shell, or umbrella in order for you to operate in in Mexico. So, you can concentrate on your core business. The typical operation of the shelter will be the same as an IMMEX company, exactly the same, but instead of the IMMEX operating by itself, it will be the Mexican Shelter Corporation and everything will remain the same.

So where does the Shelter company sits in regards of risk and control and liability and financial exposure?

A shelter company will be basically in the middle because it gives you the advantage of low risk, Good levels of control because you control the manufacturing part while the shelter controls the administrative part, including: taxes, payroll, and so forth. But you control the manufacturing part. On legal implications, basically, we do have legal implication because we will have a commercial contract between the two companies, but physically speaking and regarding taxes, the shelter company is the one who is liable. The government will deal with the shelter company for all tax purposes. While there are some tax implications for the foreign company, these are minimal.

And one more thing.

With the shelter you can initiate basically in 30 to 60 days the operation. Meanwhile, with your own subsidiary. You need to go through all the process of creating the company. Incorporate it, obtain a tax ID and everything, and then apply for IMMEX. Apply for a VAT certificate which might take longer than expected.

HR considerations in Mexico

Constitutionally speaking, and as stated by Mexican labour laws, all wages must be stated. Be mindfult that this doesn’t mean or imply that it must be payed, only that all wages must be stated in pesos per day.

Not hours, no weeks, no pesos per day.

Although most of the payments are weekly and you should consider 6 working days and one day off, normally, Sunday. A typical shift is comprised of 8 hours a day. Six days a week, 48 hours for a daytime shift, 42 hours for the nighttime shift and 45 hours for what is a mixed shift, that means, shifts that take some hours from the day and the night.

Anything beyond this is considered overtime, and nobody can work more than 9 hours overtime per week.

A typical payroll which is stated in pesos plus benefits, which includes social security and taxes that can go as much as 70%. I’m trying to be very Orthodox here, but probably it is less than that and for a blue-collar worker it oscillates between 60% to 65%, but 70% if you want to be on the safe side. And every time you go up on the money chart it will be less percentage on that because many of the benefits are capped to a specific maximum of salaries.

So, for a plan manager, it probably will be around 25% to 30% increment from the base salary.

There is no “trial period contract” in Mexico. There is not such a thing. Whoever tells you that is lying to you. It is does not exist under the laws of Mexico. However, what does exist is what we call training period. It lasts 30 days and it can be renewed every month for up to three months. That’s normally what happens.

There are some EHS programs, considerations, laws, and standards that will have to be followed and there is unionism in Mexico. There is something that I need to put on the table right now.

By law, by constitutional law, every single worker has the right to be unionized. That doesn’t mean that they have the obligation to be unionized. Let’s get that straight. But since they have the right to unionize, it is important that you commit with one union from the very beginning, because eventually they there will be something that you can’t control.

We can talk in depth about this situation of unionism, but it’s not something that you have to be scared of, all companies in Mexico work like that and keep good relations with their unions.

Regarding work shifts

So, just to give you an idea of two things. The shifts, which is normally what I mentioned already from Monday to Saturday, considering Sunday off unpaid.

For a typical shift, with weekends off, you can accommodate hours from Monday to Friday or Monday to Saturday; with different hours and different shifts, and when dealing with special shifts that require 24/7 operations, we can accommodate 12 hours and another 12 hours put together. Although it is legal to have 12 hours shifts one after the other, you need to agree with the workers before implementing it. Once you agree with the workers and it is signed, then it is lawful to implement a 24 hour shift.

Are you a Canadian Business owner interested in doing business in Mexico?

Not sure? Give us a call!

(514) 825-0972

Or shoot us an email!